Just after the loans to Bear Stearns from J.P. Morgan with the unlimited backing of the US Fed were announced, but before it became public that it was actually a buyout, my brother sent me a quick email:

This is [bad word removed]. Surely if the Fed bails out a large bank/ financial company they should receive some equity in return for their cash. Otherwise you just ensure the rich stay rich no matter what. Please respond with a thoughtful rightwing diatribe.

Fed moves to bail out major US bank: http://www.abc.net.au/news/stories/2008/03/15/2190458.htm

I responded with:

*) Yes, it’s [bad word removed]. It should be allowed to collapse on its own. If the government does get involved, it should be to nationalise the thing outright, close its operations and then immediately sell the various arms off to the highest bidders on the market. The government should not attempt to keep it running as a going concern (as the UK is with Northern Rock).

——

*) No, it’s not [bad word removed]. It is commonly said (including by me) that central banks have two tasks: control inflation and minimise unemployment. The US Fed, unlike most central banks, (a) does not have real independence from the executive or legislature; and (b) is forced to consider unemployment at the same time as inflation. For the BoE, RBA and ECB, fighting inflation comes first and ONLY THEN, when it’s under control, do they look at unemployment.

This isn’t quite true, though. The US Fed actually has three roles:

a) As an independent institution, to control inflation, but not — as yet — with an explicit target like the BoE, RBA and ECB have;

b) As a semi-independent institution, to minimise unemployment; and

c) As simply one of a collection of government agencies working together, to ensure the ongoing stability of the financial system.That third point, for the US, takes absolute priority over everything else. To be honest, it does in Britain, Australia and Europe as well. It’s important because if the entire financial system melts down, you end up with 3rd-world-style catastrophes and we know that those aren’t fun.

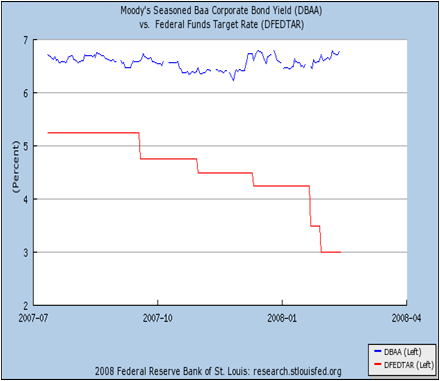

It was clearly on that third point that the US Fed offered its recent US$200 billion facility to the market at large and also on that third point that they declared Bear Stearns too big to fail. They are clearly worried that that the market is a long way from rational right now and that the collapse of even one investment bank would have domino effects that really would threaten the entire system.

——

Personally, I think the US$200 billion facility was reasonable but I think the Bear Stearns bail-out was not. I appreciate the domino risk, but so long as the Fed is acting to ensure that there is market liquidity, I don’t think there is too much cause for concern. To the extent that they prop Bear Stearns up at all, it should be under the explicit understanding that a) it is short term; b) Bear Stearns open their books to the world; c) Bear Stearns negotiate for someone else to buy them out; and d) if they fail to sell themselves within a month, they get nationalised and the Fed then sells it off in chunks.

Some people are likening the Fed’s reactions to those of the Bank of Japan in the 1990s: propping up banks and ought-to-be-bankrupt borrowers so their financial system never had to recognise the dodgy loans on their books. As far as I can tell, the two main differences are that a) the BoJ initially had much lower interest rates, so they had less room to manoeuvre in keeping the real economy out of recession; and b) the US banks are notionally required to “mark to market” when doing their accounts rather than their preferred “mark to model”, which means that so long as the market for sub-prime-mortgage-backed assets is illiquid, they’re obliged to mark those assets as having a value of zero. That is, they’re forced to recognise the bad loans upfront rather than hanging on to them for a decade or so.

And this morning I wake up to this:

In a shocking deal reached on Sunday to save Bear Stearns, JPMorgan Chase agreed to pay a mere $2 a share to buy all of Bear – less than one-tenth the firm’s market price on Friday.

Well, waddayaknow …