Continuing on from my previous wondering about how panic-driven and effective current US (monetary) policy is, I notice these two posts from Paul Krugman …

Ben Bernanke has cut interest rates a lot since last summer. But can he make a difference? Or is he just, as the old line has it, pushing on a string?

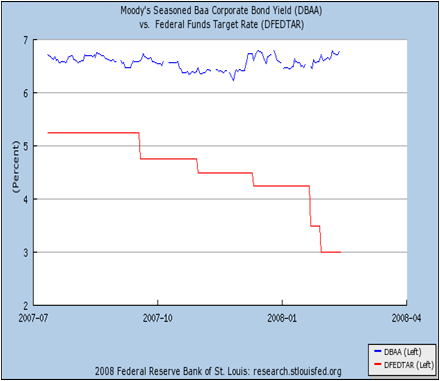

Here’s the Fed funds target rate (red line) — which is what the Fed actually controls — versus the interest rate on Baa corporate bonds (blue line), which is probably a better guide to what matters for actual business spending.

It’s pretty grim. Basically, deteriorating credit conditions have offset everything the Fed has done. Doubleplus ungood.

… and Brad DeLong …

Further cuts in the federal funds rate are on the way. Ben Bernanke is talking about how we are in a slow-moving financial crisis of DeLong Type II: one in which large financial institutions are insolvent–“pressure on bank balance sheets”–and in which lower short-term interest rates and a steeper yield curve are a way of providing institutions with the life jackets they need to paddle to shore.

Larry Meyers has pointed out that the BBB yield is no lower than it was in July–that all the easing has had no effect on the cost of capital that the financial markets feed to the “real economy,” and hence that Fed policy today is no more stimulative than it was last summer.

I’m more inclined to agree with Brad’s assessment than Paul’s implicit prediction of gloom, although it depends on what you think the Fed should be looking at. Paul is clearly hoping for a decrease in long-term rates so-as to stimulate the real economy, while Brad is simply noting that steeper yield curves, manifested here through a drop in base rates and no movement in longer-term paper, are pumping up banks’ profit flows, which will help them deal with the hideous losses from the sub-prime mess, the monoline insurer implosion and all the other nasties out there.

This seems like pretty clear “Bernanke put” behaviour to me. The banks need the short-term increase in profit flows in order to stay solvent in the medium-term. Whether Mr Bernanke is pushing down the base rate because the banks can’t lift the yields on long-term debt or because he doesn’t want them to (since that would hit the real economy) is a moot point.

This doesn’t change the fact that Bernanke is slopping out the good times to save the industry from its own mistakes. It’s probably safe to say that there’ll be no more knuckles rapped (except maybe those of the ratings agencies), so the real question is whether they’ll be allowed to make the same mistakes again …