In addition to his previous comments on the bailouts [25 Aug, 27 Aug, 28 Aug], which I highlighted here, Tyler Cowen has added a fourth post [2 Sep]:

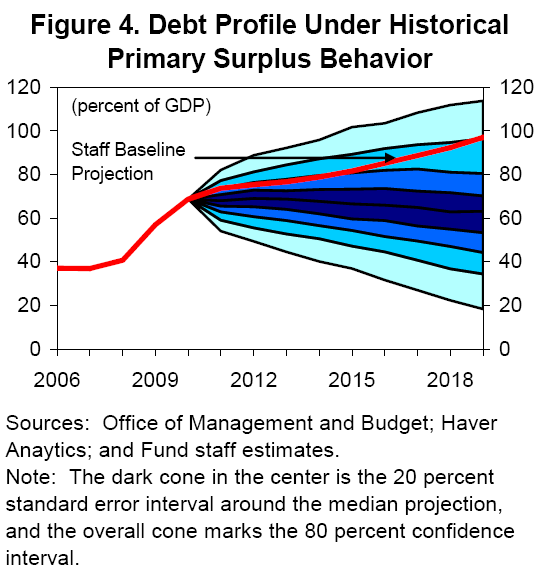

I side with Bernanke because an economy can withstand only so much major bank insolvency at once. Lots of major banks were levered up 30-1 or so. Their assets fell in value more than a modest amount and then they were insolvent, sometimes grossly so. (A three percent decline in asset values already puts you into insolvency range.) If AIG had gone into bankruptcy court, some major banks would have been even more insolvent. Or if Frannie securities had been allowed to find their non-bailout values. My guess is that at least 15 out of the top 20 U.S. banks would have been flat-out insolvent if, starting at the time of Bear Stearns, all we had done was loose monetary policy and no other bailouts. Subsequent contagion effects, and the shut down of short-term repo markets, and a run on money market funds, would have made even more financial institutions insolvent. The world as we know it then becomes very dire, both for credit reasons and deflation reasons (yes you can print up currency to keep measured M up and running but the economy still collapses). So we needed not just emergency lending but also resource transfers to banks, basically to put them back into the range of possible solvency.

I really like to see Tyler’s evolving attitudes here. It lets me know that mere grad students are allowed to not be sure of themselves.

Imagine being Bernanke/Paulson two days before Lehman Brothers went down: you know they’re going to go down if you don’t bail them out and you know that to bail them out creates moral hazard problems (i.e. increases the likelihood of a repeat of the entire mess in another 10 years). You don’t know how close to the edge everyone else is, nor how large an effect a Lehman collapse will have on everyone else in the short-run (thanks, in no small part, to the fact that all those derivatives were sold over-the-counter), but you’re nevertheless almost certain that Lehman Brothers are not important enough to take down the whole planet.

In that situation, I think of the decision to let Lehman Brothers go down as an experiment to allow estimation of the system’s interconnectedness. Suppose you’ve got a structural model of the U.S. financial system as a whole, but no empirical basis for calibrating it. Normally you might estimate the deep parameters from micro models, but when derivatives were exempted from regulation in the 2000 Commodities Futures Modernization Act, in addition to letting firms do what they wanted with derivatives you also gave up having information about what they were doing. So instead, what you need is a macro shock that you can fully identify so that at least you can pull out the reduced-form parameters. Letting Lehman go was the perfect opportunity for that shock.

I’m not saying that Bernanke had an actual model that he wanted to calibrate (although if he didn’t, I really hope he has one now), but he will certainly have had a mental model. I don’t even mean to suggest that this was the reasoning behind letting Lehman go. That would be one hell of a (semi) natural experiment and a pretty reckless way to gather the information. Nevertheless, the information gained is tremendously valuable, both in itself and to society as a whole because it is now, at least in part, public information.

To some extent, I feel like the ideal overall response to the crisis from the Fed and Treasury would have been to let everyone fail a little bit, but that isn’t possible — you can’t let an institution become a little bit bankrupt in the same way that you can’t be just a little bit pregnant. To me, the best real-world alternative was to let one or two institutions die to put the frighteners on everyone and discover the degree of interconnectedness of the system and then save the rest, with the nature and scale of the subsequent bailouts being determined by the reaction to the first couple going down. I would only really throw criticism at the manner of the saving of the rest (especially the secrecy) and even then I would be hesitant because:

(a) it was all terribly political and at that point the last thing Bernanke needed was a financially-illiterate representative pushing his or her reelection-centred agenda every step of the way (we don’t let people into a hospital emergency room when the doctor isn’t yet sure of what’s wrong with the patient);

(b) perhaps the calibration afforded by the collapse of Lehman Brothers convinced Bernanke-the-physician that short-term secrecy was necessay to “stop the bleeding” (although that doesn’t necessarily imply that long-term secrecy is warranted); and

(c) there was still inherent (i.e. Knightian) uncertainty in what was coming next on a day-to-day basis.