Everybody’s wringing their hands over the fact that the US economy suffered a net loss of 533,000 jobs in November. That’s an awful lot and it’s gotta hurt. Most media outlets are also observing that it’s the worst month for employment since 1974. Here is the Wall Street Journal:

The U.S. lost half a million jobs in November, the largest one-month drop since 1974, as employers brace for a recession that’s expected to stretch through much of 2009.

The New York Times:

The nation’s employers cut 533,000 jobs in November, the Bureau of Labor Statistics reported Friday.

Not since December 1974, toward the end of a severe recession, have so many jobs disappeared in a single month — and the current recession, far from ending, appears to be just gathering steam.

These facts are true, but they’re also misleading. There are two important things that nobody that I can see is mentioning:

Firstly, the population of the USA has grown by over 43% in the last 34 years. In 1974 the resident population was 213 million. Today it is 306 million [source]. Losing half a million jobs in 1974 was a much bigger event than it is today.

Secondly, a much greater share of households only had one source of income in 1974 compared to today. Back then, if the sole worker lost their job, the family was in serious trouble. Today, if one of the (more often than not) two workers in a household loses their job, the family still suffers but far less than they would have back then.

Both of those will be cold comfort to anyone losing their job, but when watching events at a macroscopic level – looking at the country as a whole – it’s important to keep some perspective.

As a side note: The entry of women into the workforce will have served to reduce at least the scale, if not the likelihood, of a catostrophic loss of income to a household in the sense of Carroll (QJE 1997) (the paper is downloadable here). What work has been done investigating the links between female participation rates (or, more generally, the number of workers per household) and the extent of buffer-stock saving?

Update:

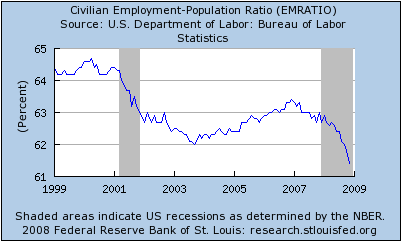

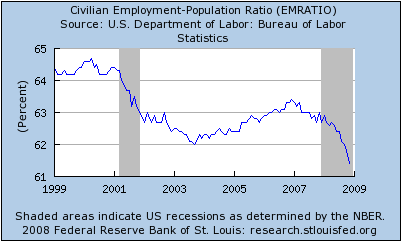

Paul Krugman looks at the ratio of employed people to total population:

Calculated Risk looks at the Year-over-Year percentage change in employment.

You’ll note, though, that they are both bloggers and not mainstream media.