In what Tyler Cowen calls “Critically important stuff and two of the best recent economics blog posts, in some time,” Paul Krugman and Brad DeLong have got some interesting thoughts on US interest rates. First Krugman:

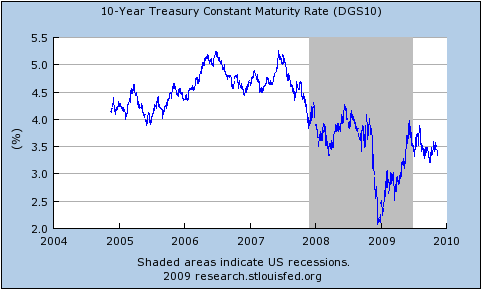

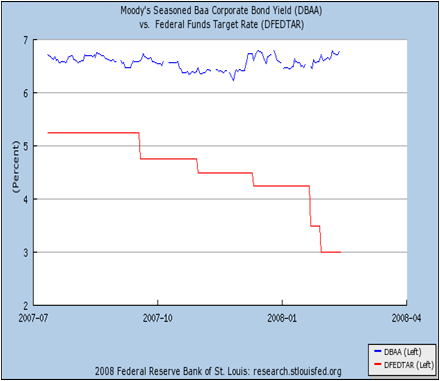

On the face of it, there’s no reason to be worried about interest rates on US debt. Despite large deficits, the Federal government is able to borrow cheaply, at rates that are up from the early post-Lehman period … but well below the pre-crisis levels:

Underlying these low rates is, in turn, the fact that overall borrowing by the nonfinancial sector hasn’t risen: the surge in government borrowing has in fact, less than offset a plunge in private borrowing.

So what’s the problem?

Well, what I hear is that officials don’t trust the demand for long-term government debt, because they see it as driven by a “carry trade”: financial players borrowing cheap money short-term, and using it to buy long-term bonds. They fear that the whole thing could evaporate if long-term rates start to rise, imposing capital losses on the people doing the carry trade; this could, they believe, drive rates way up, even though this possibility doesn’t seem to be priced in by the market.

What’s wrong with this picture?

First of all, what would things look like if the debt situation were perfectly OK? The answer, it seems to me, is that it would look just like what we’re seeing.

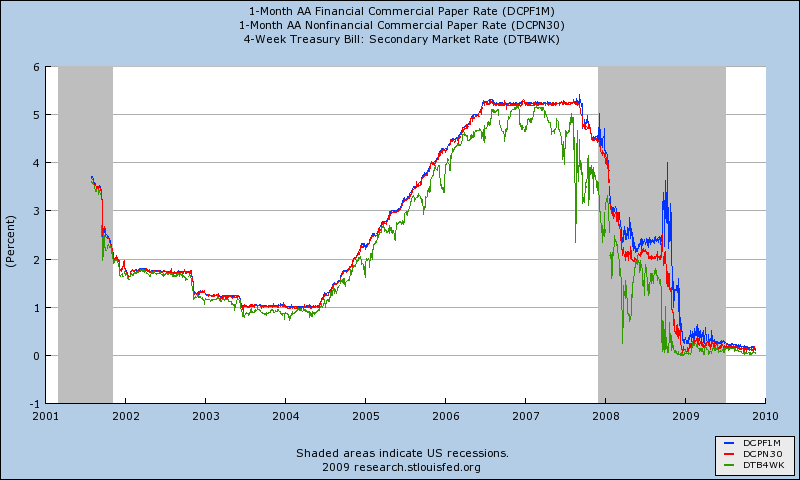

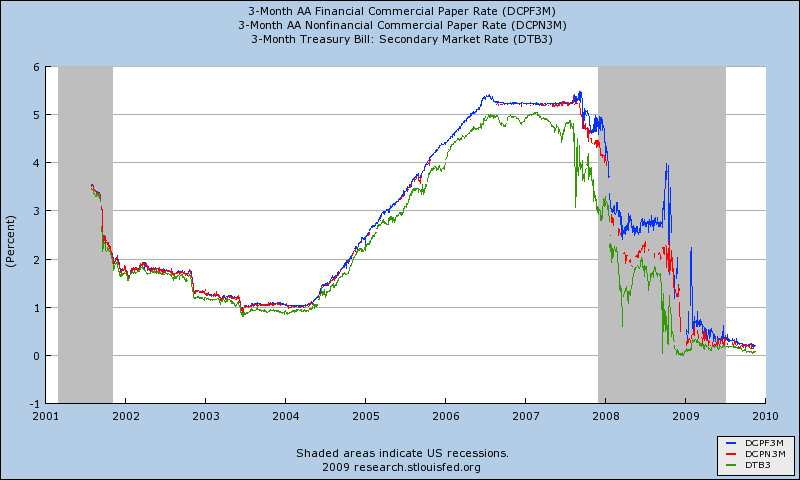

Bear in mind that the whole problem right now is that the private sector is hurting, it’s spooked, and it’s looking for safety. So it’s piling into “cash”, which really means short-term debt. (Treasury bill rates briefly went negative yesterday). Meanwhile, the public sector is sustaining demand with deficit spending, financed by long-term debt. So someone has to be bridging the gap between the short-term assets the public wants to hold and the long-term debt the government wants to issue; call it a carry trade if you like, but it’s a normal and necessary thing.

Now, you could and should be worried if this thing looked like a great bubble — if long-term rates looked unreasonably low given the fundamentals. But do they? Long rates fluctuated between 4.5 and 5 percent in the mid-2000s, when the economy was driven by an unsustainable housing boom. Now we face the prospect of a prolonged period of near-zero short-term rates — I don’t see any reason for the Fed funds rate to rise for at least a year, and probably two — which should mean substantially lower long rates even if you expect yields eventually to rise back to 2005 levels. And if we’re facing a Japanese-type lost decade, which seems all too possible, long rates are in fact still unreasonably high.

Still, what about the possibility of a squeeze, in which rising rates for whatever reason produce a vicious circle of collapsing balance sheets among the carry traders, higher rates, and so on? Well, we’ve seen enough of that sort of thing not to dismiss the possibility. But if it does happen, it’s a financial system problem — not a deficit problem. It would basically be saying not that the government is borrowing too much, but that the people conveying funds from savers, who want short-term assets, to the government, which borrows long, are undercapitalized.

And the remedy should be financial, not fiscal. Have the Fed buy more long-term debt; or let the government issue more short-term debt. Whatever you do, don’t undermine recovery by calling off jobs creation.

The point is that it’s crazy to let the rescue of the economy be held hostage to what is, if it’s an issue at all, a technical matter of maturity mismatch. And again, it’s not clear that it even is an issue. What the worriers seem to regard as a danger sign — that supposedly awful carry trade — is exactly what you would expect to see even if fiscal policy were on a perfectly sustainable trajectory.

Then DeLong:

I am not sure Paul is correct when he says that the possible underlying problem is merely “a technical matter of maturity mismatch.” The long Treasury market is thinner than many people think: it is not completely implausible to argue that it is giving us the wrong read on what market expectations really are because long Treasuries right now are held by (a) price-insensitive actors like the PBoC and (b) highly-leveraged risk lovers borrowing at close to zero and collecting coupons as they try to pick up nickles in front of the steamroller. And to the extent that the prices at which businesses can borrow are set by a market that keys off the Treasury market, an unwinding of this “carry trade”–if it really exists–could produce bizarre outcomes.

Bear in mind that this whole story requires that the demand curve slope the wrong way for a while–that if the prices for Treasury bonds fall carry traders lose their shirts and exit the market, and so a small fall in Treasury bond prices turns into a crash until someone else steps in to hold the stock…

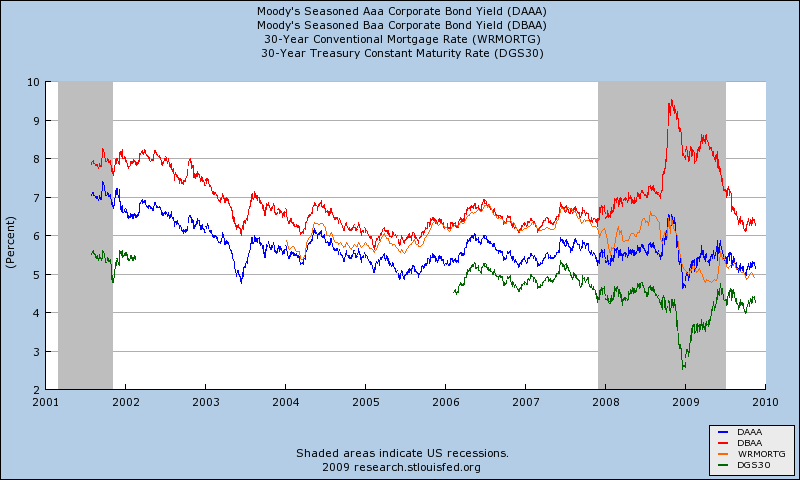

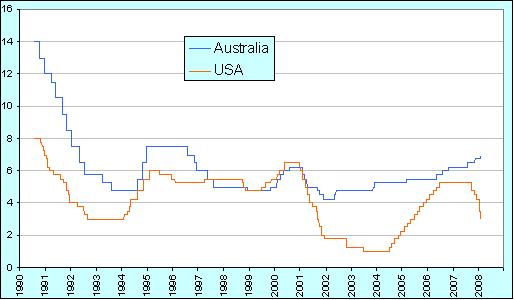

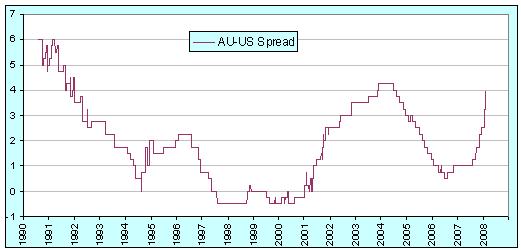

For reference, here are the time paths of interest rates for a variety of term lengths and risk profiles (all taken from FRED):

To my own mind, I’m somewhat inclined to agree with Krugman. While I do believe that the carry trade is occurring, I suspect that it’s effects are mostly elsewhere, or at least that the carry trade is not being played particularly heavily in long-dated US government debt relative to other asset markets.

Notice that the AAA and BAA 30-year corporate rates are basically back to pre-crisis levels and that the premium they pay over 30-year government debt is also back to typical levels. If the long-dated rates are being pushed down to pre-crisis levels solely by increased supply thanks to the carry trade, then we would surely expect the quantity of credit to also be at pre-crisis levels. But new credit issuance is down relative to the pre-crisis period. Since the price is largely unchanged, that means that both demand and supply of credit have shrunk – the supply from fear in the financial market pushing money to the short end of the curve and the demand from the fact that there’s been a recession.