Greg Mankiw [Harvard] recently quoted a snippet without comment from this opinion piece by Kenneth Rogoff [Harvard]:

Within a few years, western governments will have to sharply raise taxes, inflate, partially default, or some combination of all three.

Reading this sentence frustrated me, because the “will have to” implies that these are the only choices when they are not. Cutting government spending is the obvious option that Professor Rogoff left off the list, but perhaps the best option, implicitly rejected by the use of the word “sharply“, is that governments stabilise their annual deficits in nominal terms and then let the real growth of the economy reduce the relative size of the total debt over time. Finally, there is an implied opposition to any inflation, when a small and stable rate of price inflation is entirely desirable even when a country has no debt at all.

Heck, we can even have annual deficits increase every year, so long as the nominal rate of growth plus the accrual of interest due is less than the nominal growth rate (real + inflation) of the economy as a whole and you’ll still see the debt-to-GDP ratio falling over time.

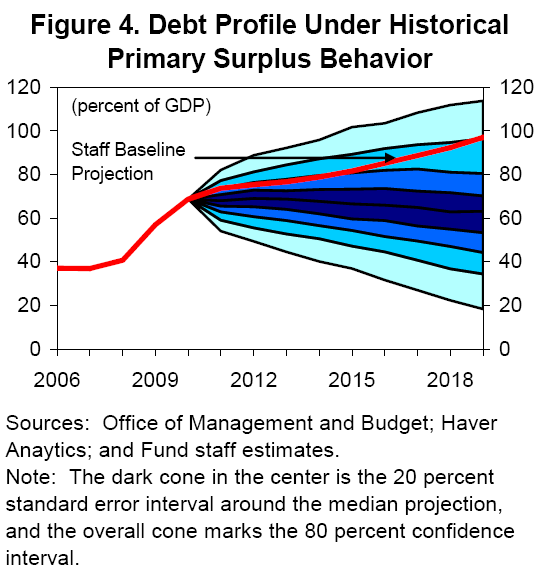

Via Minzie Chinn [U. of Wisconsin], I see that the IMF has a new paper looking at the growth rates of potential output, and the likely path of government debt in the aftermath of the credit crisis. Using the the historical correlation between the primary surplus, debt, and output gap, they ran some stochastic simulations of how the debt-to-GDP ratio for America is likely to develop over the next 10 years. Here’s the upshot (from page 37 of the paper):

Here is their text:

Combining the estimated historical primary surplus reaction function with stochastic forecasts of real GDP growth and real interest rates—and allowing for empirically realistic shocks to the primary surplus—imply a much more favorable median projection but slightly larger risks around the baseline. If the federal government on average adjusts the primary surplus as it has done in the past—implying a stronger improvement in the primary balance than under the baseline projections—the probability that debt would exceed 67 percent of GDP by year 2019 would be around 40 percent (Figure 4). Notably, with 80 percent probability, debt would be lower than the level it would reach under staff’s baseline by 2019. [Emphasis added]

So I am not really worried about debt levels for America. To be frank, neither is the the market, either, despite what you might have heard. How do I know this? Because the market, while clearly not perfectly rational, is rational enough to be forward-looking and if they thought that US government debt was a serious problem, they wouldn’t really want to buy any more of that debt today. But the US has been selling a lot of new bonds (i.e. borrowing a lot of money) lately and the prices of government bonds haven’t really fallen, so the interest rates on them haven’t really gone up. Here is Brad DeLong [Berkeley]:

[A] sharp increase in Treasury borrowings is supposed to carry a sharp increase in interest rates along with it to crowd out other forms of interest sensitive spending, [but it] hasn’t happened. Hasn’t happened at all:

It is astonishing. Between last summer and the end of this year the U.S. Treasury will expand its marketable debt liabilities by $2.5 trillion–an amount equal to more than 20% of all equities in America, an amount equal to 8% of all traded dollar-denominated securities. And yet the market has swallowed it all without a burp…

I don’t want to bag on Professor Rogoff. The majority of his piece is great: it’s a discussion of fundamental imbalances that need to be dealt with. You should read it. It’s just that I’m a bit more sanguine about US government debt than he appears to be.