Something very interesting happened to the share price of Volkswagen this week. The FT has the story:

Volkswagen’s shares more than doubled on Monday after Porsche moved to cement its control of Europe’s biggest carmaker and hedge funds, rushing to cover short positions, were forced to buy stock from a shrinking pool of shares in free float.

VW shares rose 147 per cent after Porsche unexpectedly disclosed that through the use of derivatives it had increased its stake in VW from 35 to 74.1 per cent.

…

[T]he sudden disclosure meant there was a free float of only 5.8 per cent – the state of Lower Saxony owns 20.1 per cent – sparking panic among hedge funds. Many had bet on VW’s share price falling and the rise on Monday led to estimated losses among them of €10bn-€15bn ($12.5bn-$18.8bn).

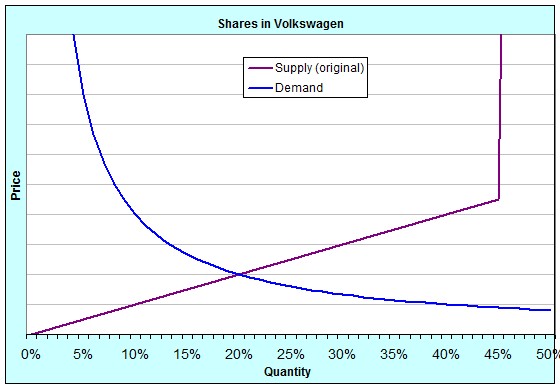

For my students in EC102, this is interesting because of the shifts in Supply and Demand and the elasticity of those curves. The buying and selling of shares in companies is a market just like any other. Here’s an idea of what the Supply and Demand curves for shares in Volkswagen were originally:

The quantity is measured as a percentage because you can only ever buy up to 100% of a company. Notice that the supply curve suddenly rockets upwards at around 45%. That’s because originally, 55% of the shares of Volkswagen weren’t available for sale. 20% was owned by the state of Lower Saxony and 35% by Porsche, and they weren’t willing to sell at any price [In reality, if you were to offer them enough money, they might have been willing to sell some of their shares, but the point is that it would have had to have been a lot]. We say that for quantities above 45%, the supply of shares was highly, even perfectly, inelastic.

Notice, too, that the demand curve is also extremely inelastic at quite low quantities. That is because a lot of hedge funds had shorted the VW stock. Shorting (sometimes called “short selling” or “going short”) is when the investor borrows shares they don’t own in order to sell them at today’s price. When it comes time to return them, they will buy them on the open market and give them back. If the price falls over that time, they make money, pocketing the difference between the price they sold at originally and the price they bought at eventually. A lot of hedge funds were in that in-between time. They had borrowed and sold the shares, and were then hoping that the price would fall. The demand at very low quantities was inelastic because they had to buy shares to pay back whoever they’d borrowed them from, no matter which way the price moved or how far.

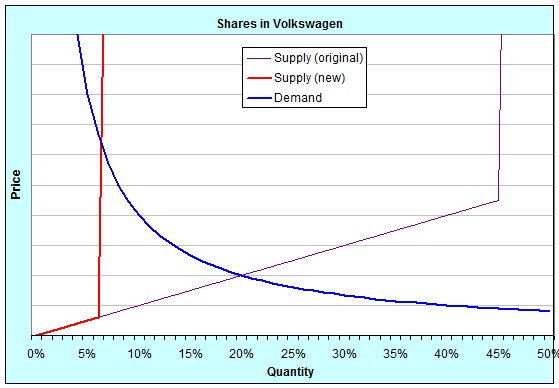

On Monday, Porsche surprised everybody by announcing that they had (through the use of derivatives like warrants and call options), increased their not-for-sale stake from 35% to a little over 74%. This meant that instead of 45% of the shares being available for sale on the open market, only 6% were. It was a shift in the supply curve, like this:

Because at such low quantities both supply and demand were very inelastic, the price jumped enormously. Last week, the price finished on Friday at roughly €211 per share. By the close of trading on Monday, it had reached €520 per share. At the close of trading on Tuesday, it was €945 per share. In fact, during the day on Tuesday it at one point reached €1005 per share, temporarily making it the largest company in the world by market capitalisation!

Who said that first-year economics classes aren’t fun?