On BBC Radio 4, Jonathan Charles — the BBC’s European correspondent in the 1990s — has done a special on the Euro and the trouble it’s experiencing. It’s well worth a listen if you have 40 minutes to spare.

It reminded me that I’d meant to write a post on two things I think ought to be done in improving the long-term outlook for the single currency. None of this is particularly innovative, but I needed to put it down somewhere, so here it is.

First, a European Fiscal Institution (EFI)

At the start of February, when Greece and her public debt was dominating the news, I wrote:

Ultimately, what the EU needs is individual states to be long-term fiscally stable and to have pan-Europe automatic stabilisers so that areas with low unemployment essentially subsidise those with high unemployment. Ideally it would avoid straight inter-government transfers and instead take the form of either encouraging businesses to locate themselves in the areas with high unemployment, or encouraging individuals to move to areas of low unemployment. The latter is difficult in Europe with it’s multitude of languages, but not impossible.

Let me hang some meat on those not-even-bones. I like the idea of a partially shared, European Fiscal Institution (EFI) that can conduct counter-cyclical spending, subject to strict limits on its mandate. I am deliberately avoiding calling it an “authority” because that implies a certain freedom of action, which I oppose. Instead, I think that an EFI should:

- be limited to implementing commonly-agreed automatic stabilisers (in particular, a universally-agreed-upon minimum level of unemployment benefits);

- be able to issue its own “Euro bonds”;

- have a mandate to retain the very highest regard for the safety of its borrowing; and

- be funded (and its bonds be guaranteed) by member countries in a manner part way between proportionate to population and proportionate to GDP.

I do not think that membership of such an institution should be required of any European country. If a non-Euro country wants to be in it, fine. If a Euro country wants to not be in it, fine.

The unemployment benefits provided would be the absolute minimum that everyone could agree on. I want to emphasise that this should be extremely conservative. If it ends up being just €100/week for the first month of unemployment, so be it; so long as it is something. Member countries would provide additional support above the minimum as they see fit.

This will have several benefits:

- It will help provide pan-European automatic stabilisation in fiscal policy.

- It will provide crucial intra-European stabilisation.

- It will increase the supply of long-dated AAA-rated securities at a time when demand for them is incredibly high.

- It will decrease the ability of Euro member countries to argue that they should be able to violate the terms of the Maastricht Treaty at times of economic hardship as at least some of the heavy lifting in counter-cyclical policy will be done for them.

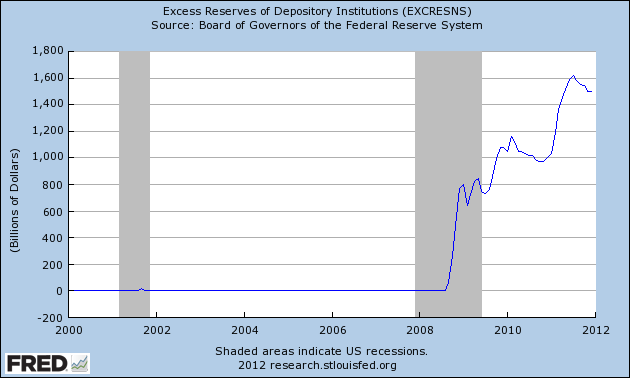

Second, country-specific lending standards

A crucial problem with a single currency is that it imposes a one-size-fits-all monetary policy on all member states, even when those states’ economies are not perfectly synchronised. Synchronisation was, and is, one of the requirements for accession to the Euro, but perfect synchronisation is impossible. In particular, inflation rates have varied significantly across the Euro-area, meaning that the common-to-all interest rates set by the ECB have been, by necessity, too low for those economies with the highest rates of inflation (e.g. Spain) and too high for those with the lowest rates of inflation (e.g. Germany).

But the (causal) link from interest rates to inflation travels via the extension of credit to the private sector, and the level of credit is determined not just from the demand side (with agents responding to changes in interest rates), but also from the supply side (with banks deciding to whom and under what conditions they will grant credit). Monetary authorities in individual member countries therefore retain the ability to influence the level of credit through regulatory influence on the supply of the same.

Altering reserve requirements for banks operating in one’s country would be the crudest version of this mechanism. A more modern equivalent would be changes to the minimum level for banks’ capital adequacy ratios. Imagine if the Spanish banking regulators had imposed a requirement of 10% deposits on all mortgages from 2005.

I suspect that the new “macro-prudential” role of the Bank of England, in addition to its role of more conventional — and, with Q.E., unconventional — monetary policy will grant them the ability to engage this sort of control. I think it will become more important over time, too, as the British economy continues its (to my mind inevitable) decline relative to the Euro-area, the UK moves closer to the textbook definition of a “small, open economy” and the BoE thus finds itself more constricted in their choice of interest rates.

Update 13 September 2010:

The new Basel III capital adequacy requirements are out and they appear to enable exactly this second idea. Good!