Here is a NY Times article doing what the NY Times does well, this time looking at the use of food stamps across America. Here are the basic details (emphasis is all mine):

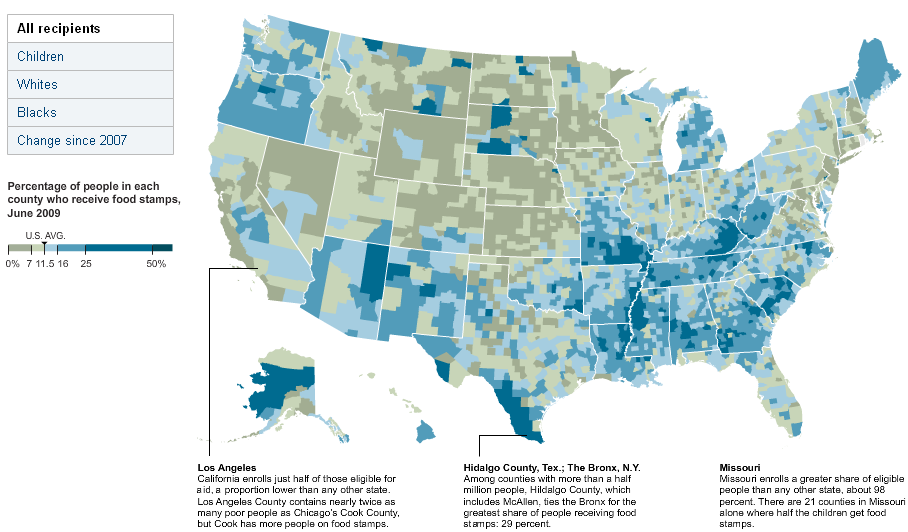

With food stamp use at record highs and climbing every month, a program once scorned as a failed welfare scheme now helps feed one in eight Americans and one in four children.

It has grown so rapidly in places so diverse that it is becoming nearly as ordinary as the groceries it buys. More than 36 million people use inconspicuous plastic cards for staples like milk, bread and cheese

[…]

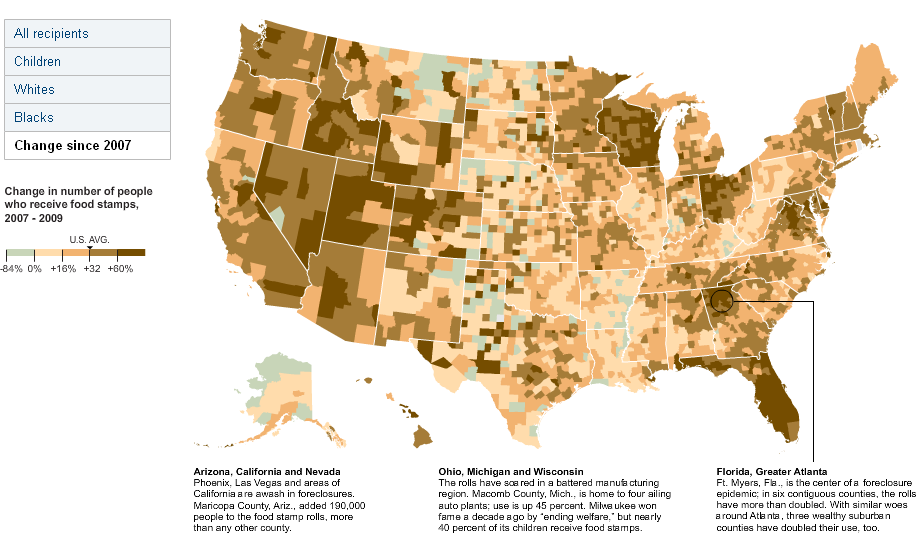

the program is now expanding at a pace of about 20,000 people a day. There are 239 counties in the United States where at least a quarter of the population receives food stamps

[…]

Nationwide, food stamps reach about two-thirds of those eligible, with rates ranging from an estimated 50 percent in California to 98 percent in Missouri. Mr. Concannon urged lagging states to do more to enroll the needy, citing a recent government report that found a sharp rise in Americans with inconsistent access to adequate food.

[…]

Unemployment insurance, despite rapid growth, reaches about only half the jobless (and replaces about half their income), making food stamps the only aid many people can get — the safety net’s safety net.Support for the food stamp program reached a nadir in the mid-1990s when critics, likening the benefit to cash welfare, won significant restrictions and sought even more. But after use plunged for several years, President Bill Clinton began promoting the program, in part as a way to help the working poor. President George W. Bush expanded that effort, a strategy Mr. Obama has embraced.

The revival was crowned last year with an upbeat change of name. What most people still call food stamps is technically the Supplemental Nutrition Assistance Program, or SNAP.

[…]

Now nearly 12 percent of Americans receive aid — 28 percent of blacks, 15 percent of Latinos and 8 percent of whites. Benefits average about $130 a month for each person in the household, but vary with shelter and child care costs.

[…]

Use among children is especially high. A third of the children in Louisiana, Missouri and Tennessee receive food aid. In the Bronx, the rate is 46 percent. In East Carroll Parish, La., three-quarters of the children receive food stamps.A recent study by Mark R. Rank, a professor at Washington University in St. Louis, startled some policy makers in finding that half of Americans receive food stamps, at least briefly, by the time they turn 20. Among black children, the figure was 90 percent.

I’m not sure how I feel about food stamps. The classically-trained economist in me wants to point out that money is fungible, so that:

- for people that, if they were given the equivalent amount of cash, would have bought the same amount of food, the program largely serves to impose unnecessary administrative costs over a simple cash transfer and places a stigma on the recipients; and

- for people that, if they were given the equivalent amount of cash, would have bought less food, the program (arguably) willfully deprives them of welfare in addition to the administrative costs and stigma.

On the other hand, we have that:

- for the (presumed) minority of recipients that have problems with drug or alcohol abuse or have a family member that has problems, receiving aid in the form of food stamps helps ensure that there’s still food on the table (although I do assume that there is a secondary market in food stamps, not to mention in food itself);

- for the recipients living in high-crime areas, the incentive to steal food stamps is lower than that to steal cash (even if there is a secondary market, it’ll be annoying to deal with and won’t give 100 cents on the dollar), so receiving food stamps is safer;

- by giving people food stamps instead of cash, you reduce the possibility of a sense of entitlement emerging (one of the major problems in countries, like Britain, with comprehensive welfare systems is that recipients can come to consider the aid they receive as their right and not just (hopefully temporary) assistance); and

- America, for some reason that is mostly beyond me, has always had trouble facing up to the moral imperative to assist those in genuine need and presenting that assistance as food stamps seems to have granted it some political cover.

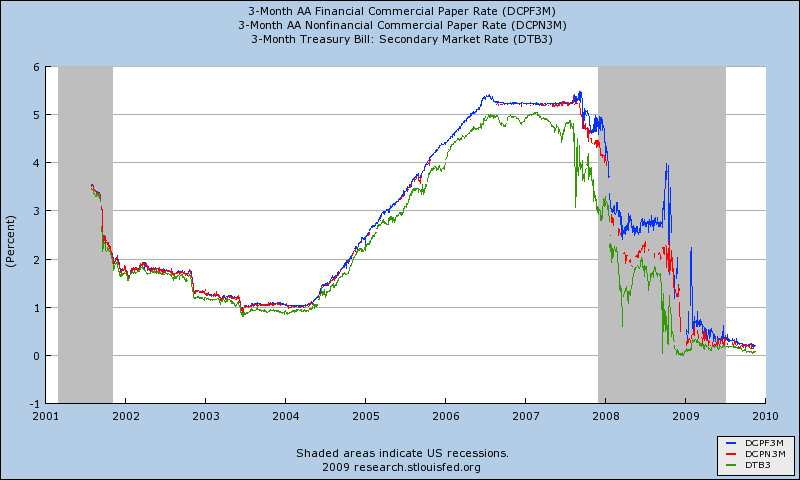

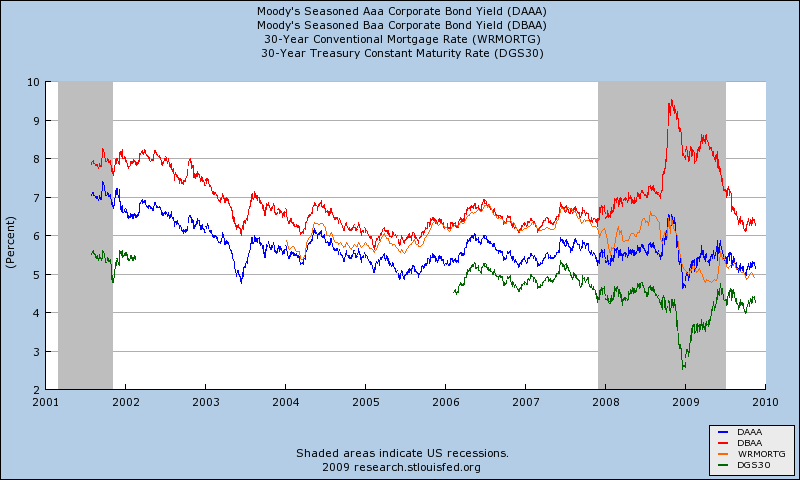

Anyway, the NY Times piece comes with some more fantastic graphics. Here are two snapshots (click-through on either of them to get to the good stuff on the NY Times website):