I like both of these answers:

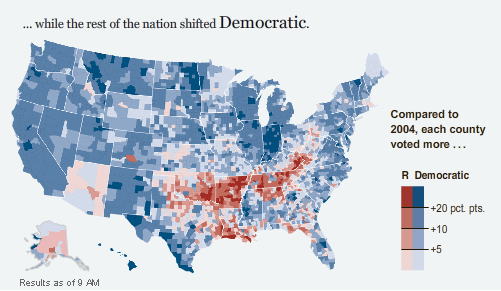

This is exactly the kind of detailed political question I don’t follow so let’s try some crude, fact-poor economism. Hillary Clinton commands the loyalties of significant segments of the Democratic Party. The implication is that Obama will need these segments for what he is trying to do. Since Obama already has 58 (?) Democratic Senators on his side, we should conclude that Obama will try to do lots in the first few months of his term; this is the “throw long and deep” scenario.

He can always encourage her to leave later, if the relationship does not work out. Latinos, on the other hand, are stronger as voters than as a lobby or as an organized segment of the Democratic Party. The implication is that they will get relatively little at the beginning of Obama’s term — when lobbies are needed — but successively more as the next election approaches.

Earlier this year, it seemed a good idea to plonk her on the ticket to defang the threat. That would have followed the “team of rivals” concept that Obama wanted to purloin from Lincoln. It would also have given the Clintons an independent claim on power. By winning without them and even, in some measure, despite them, Obama can now bring the Clintons into the power structure while retaining clear dominance. The State Department appointment is prestigious enough not to be condescending, yet also keeps Clinton off the Washington circuit more than any other position. She’ll be on a plane or abroad a great deal. Extra bonus: Bill will just love that. Sending his wife to the Middle East is the ex-president’s idea of a good time.

There’s also the small question of Iraq. Think of the appointment this way: “You voted for this bloody war, Hillary; you can end it.”

Withdrawing from Iraq will not be easy and it may well be gruesome. I have no confidence that the place won’t erupt into an even nastier civil war when the United States pulls out than it did when the United States didn’t fully push in. How does a president avoid the domestic blow-back of essentially cutting his losses on a doomed adventure? He uses Clinton as a protective shield from domestic critics. It’s also a rather brilliant manoeuvre against those elements on the right – from Fox News to Washington neocons – who came out in praise of Clinton in the spring when she sounded more hawkish than Obama on the Middle East. Having hailed Clinton as the Iron Lady of the Jews, the stab-in-the-back right will find it hard to pivot immediately and accuse her of treason if and when she ends the Iraq occupation.

But why did Hillary accept the job?

The best I can imagine off the top of my head is that (a) she really believes that the Obama presidency will be a successful one; and (b) a successful stint as Secretary of State after time in the Senate would look very, very good on the resume in eight years time.